Leading UK country markets show significant changes this summer as overall international traffic shows no growth

a week to Geneva (17 December to 24 April 2011). LBIA’s fortunes – up by almost

4% by end-August – have contrasted with the UK overall which looks set to post

a third successive year of declines. However, there was only great happiness at

LBIA today where Tony Hallwood, Commercial and Aviation Development Director,

declared: "easyJet’s high frequencies will allow far more than just weekly and

weekend leisure ski breaks, but will also attract business travel and inbound

tourism to Yorkshire." When asked about any further easyJet routes to LBIA, Ali

Gayward, easyJet UK Commercial Manager was also optimistic: "We will ensure the

success of the new route first, but we are always looking for new opportunities.”

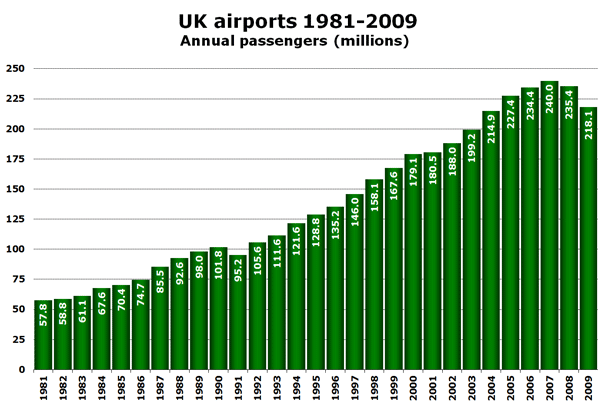

slight downward trend (and about to get a further kick in the teeth from the doubling

of the government’s treasury boosting Air Passenger Duty) it is worth remembering

that the country’s airports still handle more passengers than any other country

in Europe. Passenger numbers may have fallen two years running for the first time

in over 30 years (and will probably fall again this year) but UK airports still

saw over 218 million passenger movements in 2009, more than in Spain (187 million),

Germany (182 million), France (140 million) and Italy (130 million).

followed by the consequences of the Icelandic volcano eruption in April made for

a bad first four months. But since then there have been fewer ‘excuses’ for poor

performance. Passenger numbers across the UK’s airports in June, July and August

were remarkably similar to last year so anna.aero this week takes a closer at

what lurks beneath this apparent stability in demand. By comparing international

traffic from UK airports for the period May to August in 2010 with the same period

in 2009 some interesting and notable variations can be seen.

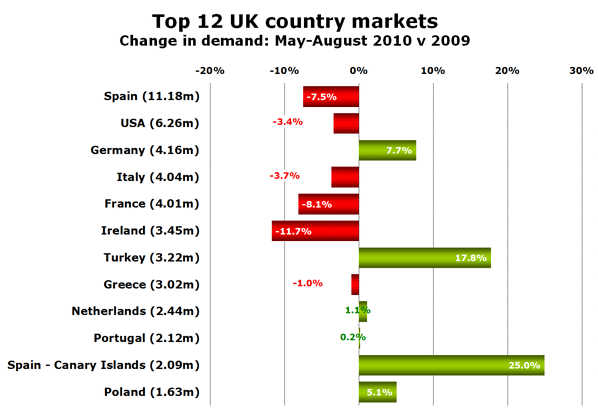

Canary Islands, Germany, Turkey up; France, Ireland, Spain down

examined is just 240,000. In May to August 2009 there were 70.62 million international

passengers at UK airports compared with 70.38 million a year later, a difference

of just 0.3%. Among the biggest 12 country markets (as defined by the CAA) nine

of them reported a change of more than 3% (either positive or negative) since

last year.

summer, with only Germany (the healthiest of the European economies?) reporting

growth. The surge in traffic to Turkey and the Canary Islands also suggests that

Brits were still more than happy to take overseas holidays if the price was right.

The Canary Islands in particular have benefited from new Ryanair services from

several UK airports, much to the annoyance of the traditional charter carriers.

recently been declining but there are signs that the market is now picking up

once more. Not surprisingly the Irish Tourism tax introduced last May has continued

to take its toll on the UK – Ireland market where the impact of a flat €10 surcharge

has been felt more keenly as the resultant fare increase is higher given the lower

average fares normally associated with such a short-haul market.

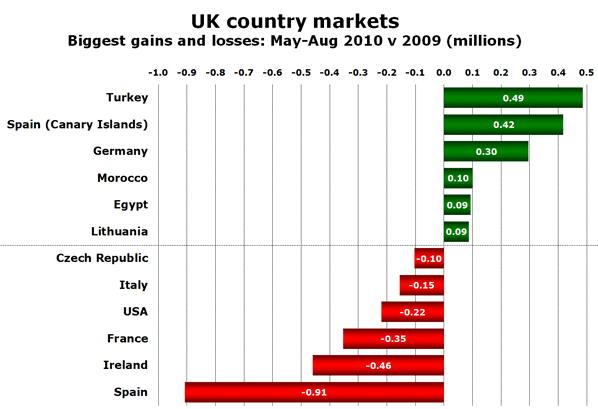

Turkey can’t wait for Christmas

becomes the fastest-growing market with an additional 490,000 passengers during

these summer months. Two other non-EU leisure markets, Egypt (+10%) and Morocco

(up 60%), also make the top six in terms of volume growth along with Lithuania.

Here the launch of new scheduled services by Ryanair from Kaunas to Bristol, Edinburgh

and London Gatwick have helped stimulate demand, as well as services from the

capital Vilnius to London Gatwick (with airBaltic), and Edinburgh and London Stansted

(with the now grounded Star1). As a result the Lithuanian market is up 80% this

summer compared with 2009.

900,000 passengers from the UK in just four months. Most of the other big volume

losses came in large markets such as France, Ireland, Italy and USA. The appearance

of the Czech Republic (basically Prague) demonstrates how holiday trends can change

rapidly. A few years ago Prague was one of the fastest-growing destinations in

the UK thanks primarily to its relatively cheap alcohol, making it a trendy destination

for the UK’s short weekend break market, travelling on low-cost carriers. However,

demand is down 18% this summer as the city suffers from what might be termed "Bilbao

syndrome". And from this winter CSA Czech Airlines will withdraw from the UK market

completely, axing its last remaining services to London Heathrow and Manchester.

markets weather the storm best in 2011. However, the combination of this further

taxation, the cancelled Heathrow runway, and the beautiful timing of a fragile

recovery, could all conspire to produce another decline in air travel demand for

an unprecedented fourth straight year in 2011 as the UK government sees if it

can ruin the UK air transport industry’s must-envied competiveness in the same

way that strikers self-destructed British car manufacturing in the 1970s.