2% fall in global air freight, by tonne kilometres, in 2012 compared to 2011

Air Cargo World reports that during 2012, there has been a decline in global air freight. Until 2011 air freight and number of air passengers roughly matched each other. And air freight roughly matched world economic growth. But since last year, passenger numbers have continued to rise, while air freight has declined. World trade has grown steadily for 3 years but has lost its correlation with air freight. Volumes of goods carried by container ships has not decreased. The reason for the decline in air freight may be that emerging economies such as China, India and Latin America were now driving global growth and were transporting bulk commodities by sea rather than flying low-volume, high-value goods. The US and Europe have lost their historic dominance and are now responsible for just 9% and 7% respectively of trade growth. Over the decade 2001 to 2011 global air freight grew by an average of 3.7%. It grew by an average of 6.1% per year from 1991 to 2001. But Boeing forecasts global air freight will grow by 5.2% annually over the next 20 years. ??

Boeing 2008/9 forecast expected global air freight to “more than triple” in 20 years. The 2012/12 forecast expects it to “more than double”

Profits up, but air freight trails passenger growth

There is a growing mismatch between the performance of the passenger and cargo sides of the airline business, IATA has revealed. A 5.3 percent growth in passenger numbers in 2012, with a 3% improvement in yield, contrasts sharply with the 2 % fall in both freight tonne-kilometers and cargo yield.

There is a growing mismatch between the performance of the passenger and cargo sides of the airline business, IATA has revealed. A 5.3 percent growth in passenger numbers in 2012, with a 3% improvement in yield, contrasts sharply with the 2 % fall in both freight tonne-kilometers and cargo yield.Inventory-to-sales ratios have stayed level for three years, however, so it wasn’t the case that businesses were stockpiling and could afford to move products more slowly. “It’s not displacement,” Perovic said.

The likely answer was that emerging economies such as China, India and Latin America were now driving global growth and were transporting bulk commodities by sea rather than flying low-volume, high-value goods. The U.S. and Europe have lost their historic dominance and were now responsible for just 9 percent and 7 percent respectively of trade growth.

Nevertheless, there is some room for optimism. “Business confidence showed some improvement in the fourth quarter. Indications are that the business environment will be more stable in the months ahead,” Perovic said. “We believe volume demand for airfreight will grow at a faster pace next year.”

IATA has upgraded its forecast for airline profits, which are now expected to reach $6.7 billion in 2012 and increase to $8.4 billion in 2013. But Tony Tyler, director general and CEO, warned at the organization’s global media day on Thursday that these revised figures represented a post-tax margin of only 1 percent and 1.3 percent respectively.

IATA calculates that the industry needs a margin of 7-8 percent to recover its cost of capital. Tyler said he would “not be surprised” if one or two airlines went bankrupt in the next few months, despite recent efficiency gains resulting from alliances and joint ventures.

Brian Pearce, IATA chief economist, said next year’s modest improvement in profitability was “far from an adequate return to investors” and would leave airlines short of the $8.8 billion they earned in 2011.

“U.S. airlines continue to improve their profitability, although they are still earning less than 2 percent,” Pearce said. “Performance in Asia-Pacific is mixed but overall profitability has not deteriorated as much as we had expected, despite the weakness of cargo markets.”

The Eurozone crisis and regulatory pressures would leave European airlines in the weakest position globally. “They will do little better than break even,” Pearce said.

Although a gradual growth in world trade in 2013 and a predicted easing in oil prices could benefit airfreight, it was “still a difficult economic environment,” Pearce warned. “There are more downside risks than upside risks, in particular the continuing weakness in European economies, the American fiscal position and Middle East geopolitical issues.”

.

.

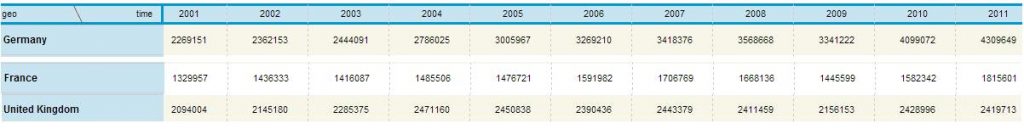

Figures of air freight (tonnes) from Eurostat for European countries

http://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&init=1&language=en&pcode=ttr00011&plugin=1

(the original contains all European countries, not only Germany, France and the UK)

This shows that German air freight tonnage has increased a lot, while that in the UK has not. For example

2006 Germany 3,418,376 tonnes and the UK 2,390,436 tonnes

2011 Germany 4,309,649 tonnes and the UK 2,419,713 tonnes

That is 1.2% growth in air freight in the UK over those 5 years, and 26% growth in Germany.

For Europe as a whole (the EU 27, of changing composition) the volume air freighted was 12,471,146 tonnes in 2007, and 13,550,644 tonnes in 2011 (which is 8.5% growth in those 4 years)

http://epp.eurostat.ec.europa.eu/portal/page/portal/transport/data/main_tables

.

.

IATA hopes global air freight will increase by a 5-year compound annual growth rate of 3%

Date added: December 7, 2012

IATA has said it expects global air freight, which has not grown much this year and declined in some regions, to grow in future. It expects an increase in global air freight in 2012 of 1.4% compared to 2011, followed by an increase over the next 5 years which compounded is 3% , up to 3.7% growth in the year 2016. In 2011 there were approximately 29.7 millions tonnes air freighted. IATA expects there to be 34.5 million tonnes air freighted in 2016. However, they expect the growth of air freight in Europe over the next 5 years to be only 2.2%, which is the slowest growth of any region. IATA expects the UK to have 1.8 million tonnes of international air freight by 2016, compared to 2.3 million tonnes in 2011, according to CAA data . By 2016, the largest international freight markets will be the United States (7.7 million tonnes), Germany (4.2 mt, China (3.5 mt, Hong Kong (3.2 mt), Japan (2.9 mt, the United Arab Emirates (2.5 mt), the Republic of Korea (1.9 mt), the UK (1.8 mt), India (1.6 mt) and the Netherlands (1.6 mt).

Click here to view full story…

.

.

The World Air Cargo Forecast 2012-2013 from Boeing states:

Boeing states, somewhat optimistically (its purpose being to sell planes):

http://www.boeing.com/commercial/cargo/wacf.pdf

Air cargo traffic contracted slightly in 2011 and 2012.

After rebounding sharply in 2010 from the depressed levels of 2009, demand for air cargo transport began to weaken in early 2011, sliding into contraction by May of that year. The slide continued into the first 8 months of 2012, with year-to-date traffic down 2%. Despite the near-term slowdown, world air cargo traffic will more than double over the next 20 years, compared to 2011 levels, for an average 5.2% annual growth rate. The number of

airplanes in the freighter fleet will increase by more than 80% over the next two decades.

In 2011, world air cargo traffic declined about 1.0%, after expanding 18.5% in 2010. This exaggerated expansion reflects a normal recovery from the precipitous drop in cargo traffic during 2008 and 2009, when traffic fell 3.2% and 9.6%, respectively—the first time that air cargo traffic contracted in two consecutive years.

If the current decline continues through the remainder of 2012, however, the years 2011 and 2012 will mark the second such occurrence. World air cargo traffic has expanded only 3.7% per year on average since 2001. Of greater concern, traffic has grown only 2.0% per year since 2004—much slower than the 6.7% historical growth trend maintained for the 23 years between 1981 and 2004. The slowing of world air cargo traffic since 2004 can largely be attributed to the global economic downturn of 2008–2009 and the rising price of fuel.

These 2 tables are from Boeing. Page 7 of link

.

.

IATA says in its press release of 13.12.2012

2013

Cargo: Cargo demand is expected to increase by 1.4% (not enough to make up for the 2.0% decline in 2012). The mismatch between growth rates for passenger and cargo demand tends to lead to cargo capacity in excess of demand and yields falling by 1.5%.

http://www.iata.org/pressroom/pr/Pages/2012-12-13-01.aspx

.

.

How do Boeing’s forecasts this year compare with their earlier forecasts?

2006/2007

In Boeing’s World Air Cargo Forecast 2006/2007, Boeing forecasts that world air cargo growth would expand at an average annual rate of 6.1 percent during the next 20 years. link

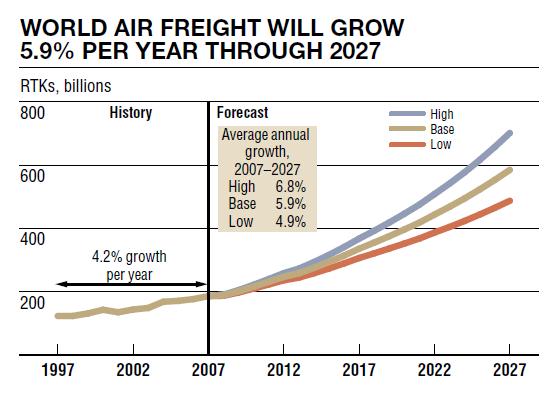

2008/2009

Low, baseline, and high annual growth of 4.9%, 5.9%, and 6.8%, respectively, are forecast for world air freight traffic. High and low scenarios correspond to GDP growth of 0.5% above longterm projections and 0.5% below, respectively.

Worldwide air freight is expected to more than triple over the next 20 years, increasing from 186.5 billion RTKs in 2007 to 585.1 billion RTKs by 2027.

Boeing Global Air Cargo Forecasts 2008/2009

[In reality, global air freight in 2012 is no higher than in 2007. The 2008/9 forecast expects global air freight to “more than triple” in 20 years, but the 2012/12 forecasts expect it to “more than double“].

Below are the predictions from the 2008/9 Boeing forecasts:

.

.

Earlier

Air Freight forecast annual growth of 4.8% 2006 – 2011

17.11.2007

The International Air Transport Association is offering a somewhat subdued forecast

for international freight growth over the next five years.

IATA said in its new projections for the airline industry that international

air freight tonnage should growth at an average annual rate of 4.8% between 2006

and 2011.

That’s not only well behind the 6.4% average annual growth some experts forecast

over the next 20 years, it’s far off the average 6.2% annual growth air carriers

reported from 2002 to 2006.

Released at the annual Arab Air Carriers Organization meeting in Damascus last

month, the forecast also takes a downbeat view of passenger demand.

IATA projects average 5.1% annual growth in passenger traffic through 2011, down

from the 7.4% yearly average between 2002 and 2006.

http://www.aircargoworld.com/news/#c