The case for building new airport capacity for business travellers does not stack up, say environmental campaigners ahead of an independent commission’s report that is expected to suggest locations for new runways on Tuesday.

Despite an improvement in the economy, business flights have not picked up from the decline they have been experiencing for more than a decade, says WWF.

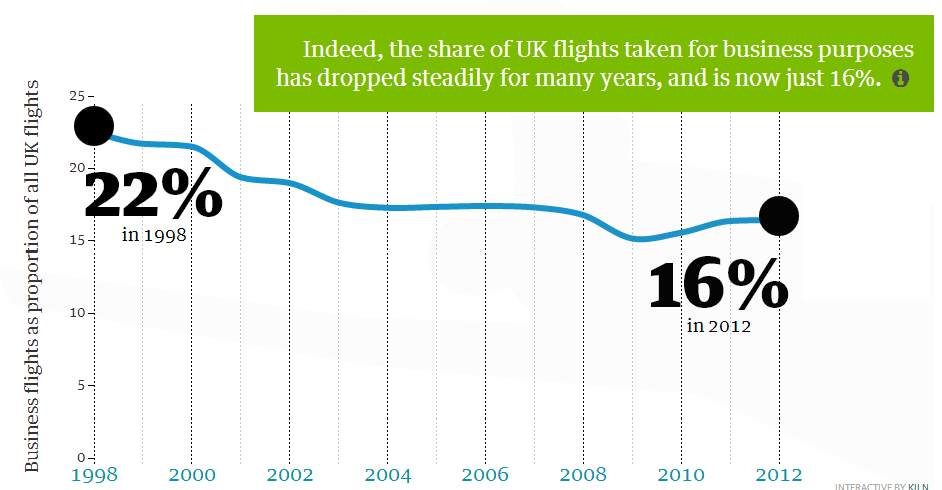

The green group analysed Civil Aviation Authority figures, [link to infographic] which show business trips by air are down 13% since 2000, and down as much as 23% at Heathrow, where the aviation industry has argued for a third runway despite Labour, the Conservatives and Liberal Democrats all opposing such an expansion. Although business flights have shown a modest recovery after they plunged between 2008 and 2009 following the financial crash, they are still well below 2000 levels.

The intervention comes as Sir Howard Davies’ Airports commission prepares to publish its interim report on Tuesday narrowing down options for new capacity, ahead of a final report due after the next general election in 2015. Early drafts have reportedly suggested a new runway at Heathrow and additional capacity at Gatwick.

Davies said in October that while some growth forecasts were “over-optimistic”, he believed the level of growing demand for flights was striking and that the UK needed new runways.

Jean Leston, transport policy manager of WWF-UK, said: “The Airports Commission seems to have bought the line that business needs airport expansion. But where’s the evidence to prove it? At Heathrow, now the most likely site for a new runway, figures show that business flying has been on the decline for over a decade, even before the recession.”

She continued: “We’re being sold airport expansion under false pretences. Heathrow’s growth projections simply don’t match the reality.”

A new campaign, Let Britain Fly, backed by the heads of 100 businesses including 3i Group, Asda, Hilton, John Lewis, Lloyd Banking Group, and UK Power Networks, launched in November to lobby for airport expansion. It cites Department for Transport figures suggesting [this links to the 2011 figures; the more up to date 2013 figures at link ] business flight demand is forecast to grow 80% by 2030.

[AW note: The DfT 2011 constrained forecast has 42 mppa business passengers in 2010 and 72 mppa in 2030 which is about 72% growth. Page 153 of link The figures in the 2013 DfT forecasts show 43.1 mppa business passengers in 2010, and 69.8 mppa in their central forecast, in 2030, which is a 62% increase. Page 157 of link The forecasts have considerable uncertainties in forecasting business travel, as the extent to which electronic communication will replace air travel for some trips in future is unclear ]

A spokesman for the “Let Britain Fly”campaign said: “The case for airport expansion is compelling, Heathrow has been full for a decade whilst looking ahead all of London’s main airports are forecast to be full by the mid 2020s. Of course environmental concerns must be taken seriously but we should be mindful of the fact that the independent Climate Change Committee has concluded that a 55% increase in flights by 2050 is compatible with the UK’s carbon reduction targets.”

WWF says the decline in business flights is part of a structural shift by businesses, unconnected to the recession, as they move to embrace video-conferencing and save money.

http://www.theguardian.com/environment/2013/dec/16/business-case-airport-expansion-wwf

.

.

Does the UK really need more runways for business flights? – WWF interactive

16.12.2013 (Guardian)

Part of the infographic from WWF – showing what Heathrow would like to see happen But business flying at Heathrow has fallen by 23% since 2000 – and not because of capacity or the recession

But business flying at Heathrow has fallen by 23% since 2000 – and not because of capacity or the recession

The proportion of business flights, considering all of the UK, has fallen and is has not increased for years.

The proportion of business flights, considering all of the UK, has fallen and is has not increased for years.

.

.

What is more, our evidence shows that business flying is permanently grounded with little FTSE 500 interest in returning to pre-recession flying levels as business meeting and travel practices have shifted in favour of lower carbon alternatives.

What is more, our evidence shows that business flying is permanently grounded with little FTSE 500 interest in returning to pre-recession flying levels as business meeting and travel practices have shifted in favour of lower carbon alternatives.