Chancellor cuts rate of Air Passenger Duty for long haul (over 4,000 miles) flights from 1st April 2015

In the Budget 2014 the Chancellor has announced that rates of Air Passenger Duty (APD) are to be reduced for flights of over 4000 miles from London, from April 2015. Rates of APD will rise by the rate of inflation (RPI) during 2014. After 1st April 2015, distance bands for all journeys longer than 2,000 miles will all be lumped together. While the rate of APD during 2014 (from 1st April 2014) is £13 for a return trip below 2,000 miles (anywhere in Europe), and the rate for journeys of 2,000 to 4,000 miles in length is £69 – the rates from April 2015 will be £13 for the short flights, and £71 for all other distances. The rates of APD in 2015 for premium classes will be £26 and £142. Commenting on this retrograde move by the Chancellor, the Aviation Environment Foundation said it is a backward step environmentally and economically. Aviation is already massively under-taxed compared with the £10 billion that would be raised per annum if aviation wasn’t exempted from fuel taxes and VAT. APD was a means of redressing this problem but any cut means that taxes will have to be raised elsewhere to balance government spending. Long-haul flights contribute more greenhouse gases in absolute terms than shorter flights. It is therefore right that the duty is proportional to the distance flown and the associated emissions. Eliminating bands C and D breaks the link between environmental impacts and tax and breaches the principle of fairness.

.

Tweet

New rates of APD after 1st April 2015 compared with during 2014:

| Lower (standard) rate | Higher rate | |||

| 2014 | From 1.4.2015 | 2014 | From 1.4.2015 | |

| Band A. 0 – 2000 miles | £13 | £13 | £26 | £26 |

| Band B. 2000 – 4000 miles | £69 | £71 | £138 | £142 |

| Band C. 4000 – 6000 miles | £85 | £71 | £170 | £142 |

| Band D Over 6000 miles | £97 | £71 | £194 | £142 |

.

2014 Budget: APD cut a backward step economically and environmentally

Mar 19th 2014

The Aviation Environment Federation (AEF) was surprised and shocked by the announcement in the Budget Statement1 that Air Passenger Duty (APD) on long haul flights over 4000 miles will be reduced from 1st April 2015..

Distance bands C and D will be merged with band B, lowering the tax on all these longer flights to the band B rate. Using existing 2013 rates, (which rise by the rate of RPI on 1st April 2014) this means that after April 2015, all flights over 2000 miles will pay the band B rate starting at £71 for an economy ticket, irrespective of distance, instead of the current £83 (for band C flights over 4000 miles) and £94 (for band D flights over 6000 miles).

The Treasury estimates that this will reduce projected APD revenue by around £0.25billion by 2018, although overall, APD revenue will continue to rise due in part to confirmation in the Budget that Bands A and B will increase in line with the Retail Price Index (RPI).

AEF Director Tim Johnson said: “This is a backward step environmentally and economically. Aviation is already massively under-taxed compared with the £10 billion that would be raised per annum if aviation wasn’t exempted from fuel taxes and VAT. APD was a means of redressing this problem but any cut means that taxes will have to be raised elsewhere to balance government spending and maintain public services.”

The banding distance also provided a link with environmental impacts. The current banding system, while not perfect, helped to reinforce this link.

Tim said “Long-haul flights contribute more greenhouse gases in absolute terms than shorter flights. It is therefore right that the duty is proportional to the distance flown and the associated emissions. Eliminating bands C and D breaks the link between environmental impacts and tax and breaches the principle of fairness.”

The government claims that the tax cut will help business and trade but there is no evidence to substantiate this. AEF does not accept that a marginal reduction on the overall cost will provide any additional incentive: it is inconceivable that a senior business person, needing to fly to negotiate a multi-million pound deal, would be put off by a £30 tax differential.

.

.

The Aviation Environment Federation (AEF) is a UK based organisation working to ensure that aviation takes full account of its social and environmental impacts.

1. Budget 2014 is available online: https://www.gov.uk/government/publications/budget-2014-documents. references to APD are found in paragraphs 2.160 and 2.161 amd 1.128

These say:

2.160

Air Passenger Duty (APD) rates for 2014-15 – As announced at Budget 2013, APD

rates for 2014-15 will rise in line with RPI from 1 April 2014. (Finance Bill 2014)

2.161

APD structure and rates – Budget 2014 announces that from 1 April 2015, the

government will reform APD by merging bands B, C and D, and uprating bands A and B

by the RPI. The government will also set the higher rates that apply to private business jets

offering an enhanced level of comfort to 6 times the reduced rate, as set out in the ‘Overview of Tax Legislation and Rates 2014’. The government will also consult on making greater tax transparency in ticket sales. (Finance Bill 2014) (36)

1.128

To help British businesses strengthen links with high growth markets, and to go further

to make the UK an attractive option for business visitors and tourists, Budget 2014 announces that the government will reform air passenger duty (APD) by abolishing bands C and D from 1 April 2015. This will eliminate the two highest rates of APD charged on flights to countries over 4,000 miles from Britain, cutting tax for millions of passengers travelling to China, India, Brazil and many other emerging markets. This will mean that flights to South Asia and the Caribbean will pay tax at the lower band B rate. The rates applying to private jets which offer an enhanced level of comfort will be set at 6 times the level of rates applying to economy class. The government will also extend the scope of the existing Regional Air Connectivity Fund to include start-up aid for new routes from regional airports.

2. There are currently 4 bands with APD on seats in the lowest class charged as follows (for 2013 – starting April 2013 to April 2014):

Band A : up to 2,000 km – £13

Band B: 2001 to 4,000 km – £67

Band C: 4001 to 6,000 km – £83

Band D: over 6,000 km – £94

.

See also:

APD rate for business jets to rise from x4 standard up to x6 by April 2015, while Treasury receipts from APD fall by £250 million by 2019

March 20, 2014

The changes to APD in the budget include 3 components; for the next 2 years the rates of APD for Band A (up to 2,000 miles) at £13 and Band B (2,000 to 4,000 miles from London) at £67 continue to rise at the rate of RPI; after April 2015 APD for distances further than 4,000 miles will be at the Band B rate of just £71; and private jets will after April 2015 pay APD at 6 times the rate for standard passengers, up from 4 times the rate in 2014 (and 2 times the rate in 2013). There were some 228 million UK air passengers in 2013, of whom some 120 million were to Europe, some 69 million were to longer haul destinations, and some 38 million were domestic. Of the long haul passengers, some 20 million were to Band C and D destinations (4,000 to 6,000 miles from London, and over 6,000 miles respectively). The Treasury estimates that the revenue generated by Air Passenger Duty will be some £3.0 billion in 2013-14,rising to £3.9 billion in 2018-19. Earlier estimates put the revenue as £4.3 billion in 2018-9. The removal of Bands C and D in 2015 is expected to reduce receipts by the Treasury by £0.2 billion a year on average from 2015-16. They anticipate £215 million less in 2015-6 rising to £250 million less in 2018-9. But they anticipate the losses will be this low due to growth in the number of air passengers

Click here to view full story…

.

Effectively a flight in standard class to somewhere like Hong Kong or further away (6,000 miles) will only be charged £71 APD for the return journey, while the rate in 2014 is £97 (a saving of £26). A flight in the 2,000 to 4,000 mile band will pay £71 for the return trip, while the rate in 2014 is £87 (a saving of £16). Air travel is already significantly under-taxed, as it pays not VAT and no fuel duty.

.

Budget 2014: Policy costings

Page 25.

Air Passenger Duty: abolish bands C and D

Measure description

This measure simplifies Air Passenger Duty (APD) from a 4 band to a 2 band system by

abolishing bands C and D from 1 April 2015. Band A will remain unchanged, covering

passengers on flights originating in the UK with a final destination 2000 miles or less from

London. The new band B will cover all passengers with a final destination of more than 2000 miles from London. The new band B will be charged at the existing planned band B rate in 2015-16 (£71 for reduced rate passengers and £142 for standard rate passengers).

The measure also increases the higher rate of APD, applicable only to luxury business jets, to 6 times the reduced rate, from 1 April 2015.

The tax base

APD is due on chargeable passengers being carried from a UK airport on chargeable aircraft. The rate charged depends upon the final destination of the passenger. There are currently four destination bands based on the distance between London and the capital city of the destination country/territory.

The tax base for this measure is all passengers currently subject to APD and travelling to

destinations more than 4000 miles from London, or aboard luxury jets subject to the higher

rate. In 2012-13, there were 97.5 million chargeable APD passengers, of which around 90

million were flying to destinations more than 4000 miles from London and would thus be

affected by the change in rate.

Static costing

The static costing is calculated by applying the pre- and post-measure APD rates to the tax base described above.

Exchequer impact (£m)

| 2014-5 | 2015 – 6 | 2016 – 7 | 2017 – 8 | 2018 – 9 | |

| Exchequer impact | 0 | – 230 | – 240 | – 250 | – 260 |

Post-behavioural costing

Behavioural adjustments are made to take into account the increase in demand for long haul flights following this change. A price elasticity of -0.6 is applied to passenger numbers travelling to the current band C and D in the lowest class of travel on the flight (usually economy class) who are therefore subject to the reduced rate. A price elasticity of -0.1 is applied to those travelling in a higher class of travel and thus being subject to the standard rate. This behavioural effect increases the number of passengers travelling to these long haul destinations and thus slightly offsets the static cost.

.

Exchequer impact (£m)

| 2014-5 | 2015 – 6 | 2016 – 7 | 2017 – 8 | 2018 – 9 | |

| Exchequer impact | 0 | – 215 | – 225 | – 230 | – 250 |

Areas of uncertainty

The main uncertainty in this costing arises from the extent of the behavioural response.

.

.

.

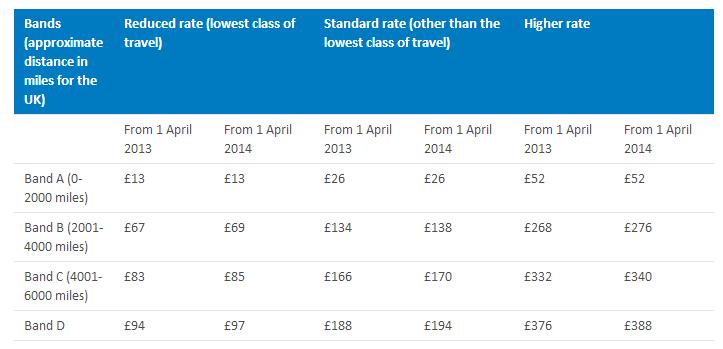

RATES of APD in 2013 and 2014:

.

New rates of APD after 1st April 2015 compared with during 2014:

| Lower rate | Higher rate | |||

| 2014 | From 1.4.2015 | 2014 | From 1.4.2015 | |

| Band A. 0 – 2000 miles | £13 | £13 | £26 | £26 |

| Band B. 2000 – 4000 miles | £69 | £71 | £138 | £142 |

| Band C. 4000 – 6000 miles | £85 | £71 | £170 | £142 |

| Band D. Over 6000 miles | £97 | £71 | £194 | £142 |

.

9 MARCH 2014

AIRPORT OPERATORS ASSOCIATION WELCOMES AIR PASSENGER DUTY REFORMS

Responding to the Chancellor’s announcement that Air Passenger Duty is to be reformed, Darren Caplan, Chief Executive of the Airport Operators Association, the trade body for UK airports, said:

“It is clear the Government has recognised that Air Passenger Duty represents a growing barrier to growth and investment, putting the UK at a competitive disadvantage compared to our nearest international rivals. The Treasury, in this Budget, has acknowledged that high levels of long-haul APD compromise our ability to provide the connectivity to both existing and emerging markets that we will need if we are to win in the global race.

“This reform of APD – together with the measures announced to assist the start-up of new routes from airports around the country – is a very welcome step from the Treasury.”

Anthony

*2.160 Air Passenger Duty (APD) rates for 2014-15 – As announced at Budget 2013, APD rates for 2014-15 will rise in line with RPI from 1 April 2014. (Finance Bill 2014)

2.161 APD structure and rates – Budget 2014 announces that from 1 April 2015, the government will reform APD by merging bands B, C and D, and uprating bands A and B

by the RPI. The government will also set the higher rates that apply to private business jets offering an enhanced level of comfort to 6 times the reduced rate, as set out in the ‘Overview

of Tax Legislation and Rates 2014’. The government will also consult on making greater tax transparency in ticket sales. (Finance Bill 2014) (36)