IATA expects global airline profits to rise by 5.1% in 2016 (and CO2 to rise by 4.6%) cf. 2015

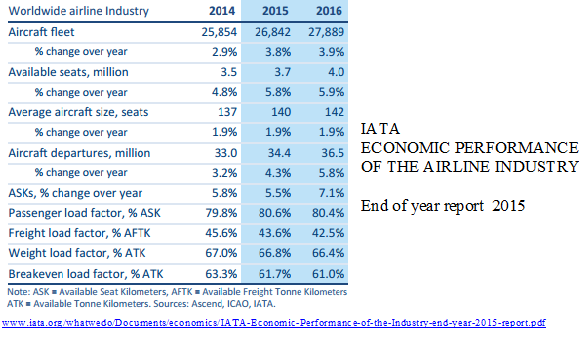

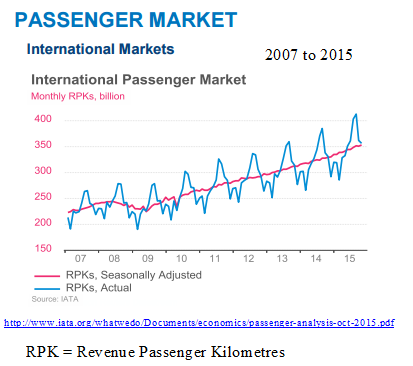

IATA, which represents some 260 airlines and 83% of global air traffic, expects profits in the industry to rise by 5.1% to $36.3 billion in 2016 – up from $33 billion in 2015. This growth is attributed to dropping oil prices and a greater demand for travel. IATA expects about 3.78 billion air passengers in 2016, travelling over 54,000 routes. There were about 3.54 billion air passengers in 2015. It says: “Air travel is accelerating, with growth of 6.9% expected next year, the best since 2010, well above the 5.5% trend of the past 20 years.” They say air passengers spend 1% of world GDP on air transport, and air transport costs have been halved over the past 20 years. They say load factors forecast to fall a little (around as capacity rises, with yet more planes being added. However, IATA is happy to say the carbon emissions per ATK (available tonne kilometres) will be 1.8% lower. However, as they expect around 7% growth, the net effect is much higher carbon emissions. The estimated increase in the use of jet fuel is about 4.2% higher this year than in 2014, and is expected to rise by 4.6% in 2016, compared to 2015. IATA says the carbon emissions from the global aviation industry were 739 million tonnes in 2014; 771 million tonnes in 2015; and 806 million tonnes in 2016. North America may generate over half of the global industry’s profit in 2016 ($19.4 billion), while European airlines could increase in profits from $5.8 billion in 2015 to $8.5 billion in 2016.

.

Tweet

IATA raises airline profit forecast

By Ben Allen (Buying Business Travel)

Tue, 15 Dec 2015

IATA report at www.iata.org/whatwedo/Documents/economics/IATA-Economic-Performance-of-the-Industry-end-year-2015-report.pdf

.

The International Air Transport Association (IATA) is forecasting a 5.1 per cent increase in airline profits in 2016.

The organisation, which represents some 260 airlines and 83 per cent of global air traffic, expects profits in the industry to rise to $36.3 billion up from $33 billion in 2015.

This growth is attributed to dropping oil prices and a greater demand for travel, with 3.8 billion passengers expected to travel over 54,000 routes in 2016.

The forecast also projects that the industry’s return on capital will exceed it’s cost of capital in both 2015 and 2016.

IATA’s CEO, Tony Tyler, said: “This is an historic achievement for an industry that has been notorious for destroying capital throughout its history. Airlines are finally meeting the minimum expectations of their shareholders.”

However, as the industry looks to be reaching the top of the business cycle, Tyler warns that the profitability is better described as “fragile than sustainable”.

North America still leads the industry’s performance, and is expected to generate more than half of the industry’s total profits ($19.4 billion), while European carriers are also expected to see a significant increase in profits from $5.8 billion in 2015 to $8.5 billion in 2016.

According to IATA, total industry revenues are expected to rise by 0.9 per cent to $717 billion.

IATA report at www.iata.org/whatwedo/Documents/economics/IATA-Economic-Performance-of-the-Industry-end-year-2015-report.pdf

http://www.iata.org/whatwedo/Documents/economics/passenger-analysis-oct-2015.pdf

.

Airlines Continue to Improve Profitability 5.1% Net Profit Margin for 2016

10 December 2015 (IATA press release)

The International Air Transport Association (IATA) announced its airline industry outlook for 2016 which sees an average net profit margin of 5.1% being generated with total net profits of $36.3 billion. IATA also announced a revision to its airline industry outlook for 2015 upwards to a net profit of $33 billion (4.6% net profit margin) from $29.3 billion forecast in June.

The strengthening industry performance is being driven by a combination of factors:

- Lower oil prices (forecast to be $55/barrel Brent in 2015 and averaging a lower $51/barrel in 2016) are giving airline profits a boost; however this is strongly moderated in many markets by the appreciation of the US dollar

- Strong demand for passenger travel (+6.7% growth in 2015 and +6.9% in 2016) is making up for disappointing cargo demand growth (+1.9% in 2015; strengthening to 3.0% in 2016). Weak cargo performance reflects sluggish growth in trade

- Stronger economic performance in some key economies (including a faster than expected recovery in the Eurozone) is outweighing the overall impact of slower growth in China and the downturn in the Brazilian economy. Global GDP growth is expected to improve to 2.7% in 2016 (up from 2.5% for 2015)

- Efficiency gains by airlines are illustrated by record high load factors (80.6% in 2015, tapering slightly to 80.4% in 2016). Capacity is increasing and is expected to move ahead of demand growth in 2016. Yields, however, continue to deteriorate amid stiff competition

“This is a good news story. The airline industry is delivering solid financial and operational performance. Passengers are benefiting from greater value than ever—with competitive airfares and product investments. Environmental performance is improving. More people and businesses are being connected to more places than ever. Employment levels are rising. And finally our shareholders are beginning to enjoy normal returns on their investments,” said Tony Tyler, IATA’s Director General and CEO.

In 2016 total passenger numbers are expected to rise to 3.8 billion traveling over some 54,000 routes.

Profitability in Perspective

In both 2015 and 2016 the industry’s return on capital (8.3% and 8.6% respectively) is expected to exceed the industry’s cost of capital (estimated to be just under 7.0% in 2015 and 2016 because of low bond yields).

“This is an historic achievement for an industry that has been notorious for destroying capital throughout its history. But let’s keep that achievement in perspective. With net profit margins still in the 5% range there is little buffer. Achieving returns that barely exceed the cost of capital means that airlines are finally meeting the minimum expectations of their shareholders. For most other industries this is the norm and not the exception.

And this is coming as expectations build that we are nearing the top of the business cycle. On average airlines will still make less than $10 per passenger carried. The industry’s profitability is better described as ‘fragile’ than ‘sustainable’,” said Tyler.

There are several indicators that improvements in airline profitability are likely to slow. The first is found in the cyclical nature of the airline business. Historically the airline industry profitability cycle is 8-9 years from peak to peak (or trough to trough). The low point of this cycle was 2009. The second is the anticipation of the economic impact of interest rates rising from current exceptionally low levels. And lastly, airlines will soon have realized the maximum positive impact of lower fuel prices with most of the higher-than-market hedges due to unwind in 2016.

2016

2016 will continue the main trends from 2015. Major drivers of performance in 2016 include:

- Revenues: Revenues are expected to rise by 0.9% to $717 billion in 2016. Industry revenues peaked in 2014 at $758 billion, then declined to $710 billion in 2015 with the impact of the strengthening of the US dollar on non-dollar revenues. The increase in revenues in 2016 is expected to be wholly due to the contribution of the passenger side of the business ($525 billion in 2015 rising to $533 billion in 2016). Cargo revenues are expected to decline slightly to $50.8 billion (from $52.2 billion in 2015).

- Demand: The demand for passenger travel is expected to grow by 6.9% (similar to the 6.7% growth expected in 2015) with 3.8 billion passengers expected to travel in 2016. Passenger capacity is expected to grow slightly ahead of demand at 7.1% which is an acceleration from the 5.5% capacity expansion in 2015. Demand for air cargo is expected to accelerate in 2016 to 3.0%, ahead of the 1.9% growth in 2015. This is slightly ahead of GDP growth which is expected to average 2.7% in 2016. Prior to the Global Financial Crisis this pace of economic growth would have generated much faster international trade and air cargo growth, but that pattern of growth appears to have stopped as companies bring supply chains closer to home. In total, the industry is expected to uplift 52.7 million tonnes of cargo in 2016.

- Yields: The cost of travel and shipping is expected to continue to decline with average yields for passengers falling 5% and cargo falling by 5.5% in 2016. The pace of decline is a deceleration from 2015 when cargo yields are expected to fall by 18.0% and passenger yields by 11.7%. About 6.0 percentage points of the 2015 decline can be attributed to the appreciation of the US dollar and the impact this has when accounting for non-US dollar revenues.

……….. and it continues …..

Full press release at

http://www.iata.org/pressroom/pr/Pages/2015-12-10-01.aspx

.

All of IATA’s press releases are at

http://www.iata.org/pressroom/pr/pages/index.aspx

.

.

.