Willie Walsh, the chief executive of IAG, said Heathrow had been premature in celebrating government approval of the project and warned that it would be “a significant challenge” for the airport to deliver a runway while keeping charges flat, as stipulated by the government.

“Do I have confidence that the current team at Heathrow can do it? No I don’t,” said Walsh

IAG, which includes the airlines Vueling, Aer Lingus and Iberia, is Heathrow’s biggest customer, operating about half of all flights at the west London airport

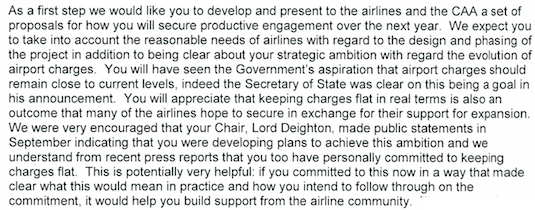

The government said the new runway had to be “delivered without hitting passengers in the pocket”, and the regulator, the Civil Aviation Authority, wrote to the airport to confirm it expected Heathrow to keep the charges low.

Walsh said Heathrow’s current plan could not be delivered without increasing charges. “Among other things, the airport will have to confirm that the [project] can be built without raising passenger charges. Can the proposal given by Heathrow to the airports commission be built and keep charges flat, no it can’t,” he said.

The IAG boss added that a runway could be built by Heathrow if there was “some radical change in their [the management’s] behaviour and thinking”, but repeated: “I’m personally not confident they can do it.”

Insisting that “there will be no ability for Heathrow to hike charges”, Walsh said: “It’s a significant new challenge for the airport and not one they have had to face up to in the past.

“If the argument is that the third runway is positive for the UK economy we’ve got to make sure that it is for the benefit of customers and not for the shareholders.”

Heathrow is owned by Spanish conglomerate Ferrovial and the sovereign wealth funds of Qatar, Singapore and China, along with two pension funds.

The airport said it intended to keep charges low. “As our biggest customer, Heathrow has been listening to IAG about the cost of the current proposal for expansion. Heathrow is determined to work with all our airline partners to deliver expansion as cost efficiently as possible – keeping landing charges low and delivering value for our passengers,” said a spokesperson.

Walsh once championed a third runway but refused to be involved in the latest lobbying after the coalition government scrapped expansion plans in 2010. But, he said: “It represents an opportunity for BA as clearly its current schedule would operate better if operated over three runways and it gives BA and other airlines an opportunity for expansion which we don’t have today.”

Walsh said air fares could rise in near future because of the effect the Brexit vote had on the value of the pound.

“Consumers are looking at price increases. Ticket prices have been declining and will continue into Q4 [the rest of 2016]. But in time if sterling continues to be weak, you are looking at increases in fares,” he said.

The drop in sterling contributed to a 3.6% decline in profits for IAG in its last quarter, which covers the most lucrative summer season. In the months to September, operating profits dropped to €1.2bn (£1.1bn), as revenues fell 4% to €6.5bn.

€162m of that was directly attributed to the currency fall for IAG, whose revenues mainly accrue through pounds spent on BA fares.

Although the short-term impact of the EU referendum was a dent to profits, he said: “Longer-term a weaker pound will mean the BA cost base is better. Our principal competition is US carriers on the transatlantic routes and we’ll have a lower cost base. It’s swings and roundabouts.”

An uncertain operating environment, terror attacks and air control strikes were also blamed by IAG as it downgraded its 2016 profit forecast once again, this time to €2.5bn, a figure that would still represent year-on-year growth of between 7% and 8%.

.