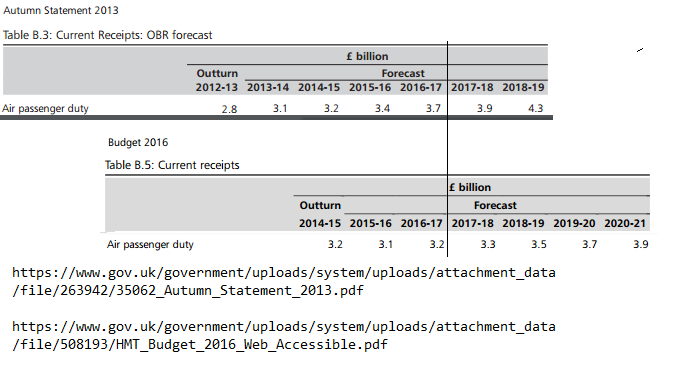

Budget shows forecast Treasury receipts from APD in 2016-17 are £500 million lower than forecast in autumn 2013

There was no mention in the March Budget by George Osborne of any changes to Air Passenger Duty, though those seeking reductions in the tax had obtained column inches in the media in recent weeks pressing for cuts. The devolution of APD to Scotland and the likely 50% cut in its rate, by the SNP, over the next few years has caused concern at northern airports about unfair competition. All the 2016 Budget statement said on APD was: “As announced at Budget 2015, all APD rates will increase by RPI from 1 April 2016. All APD rates will increase by RPI from 1 April 2017. (Finance Bill 2016 and Finance Bill 2017)”. The 2016 Budget documents do show how much lower the tax receipts are from APD this year, and how much lower forecasts are for the next few years, than they were in the 2013 forecasts, and in the 2011 forecasts. The APD receipts for 2016-17 were expected – in 2013 – to be £3.7 billion. The figure in the 2016 Budget for 2016-17 is £3.2 billion. That is £500 million less than anticipated just two and a half years earlier. The tax receipts from APD in 2018-19 were forecast in 2013 to be £4.3 billion. The figure in the 2016 Budget is for 2018-19 is just £3.5 billion. That is £800 million less than anticipated just two and a half years earlier. If it costs £40,000 to employ a nurse in the NHS for a year, £800 million would pay for 20,000 nurses.

.

Tweet

Budget 16th March 2016

No mentions of APD, just a continuation of how it was during 2015 – with rises at the rate of inflation in April 2016 and April 2017:

“Air Passenger Duty (APD) rates – As announced at Budget 2015, all APD rates will increase by RPI from 1 April 2016. All APD rates will increase by RPI from 1 April 2017. (Finance Bill 2016 and Finance Bill 2017) “

.

The actual tax receipts from Air Passenger duty (by 2016), and those anticipated in 2013 Budget statement

Tax income to the Treasury from Air Passenger Duty (APD)

2013

The Autumn Statement in 2013 showed the anticipated take from a range of UK taxes, over the period 2012-13 to 2018-19.

The full table is on Page 112 (only part of the table reproduced here)

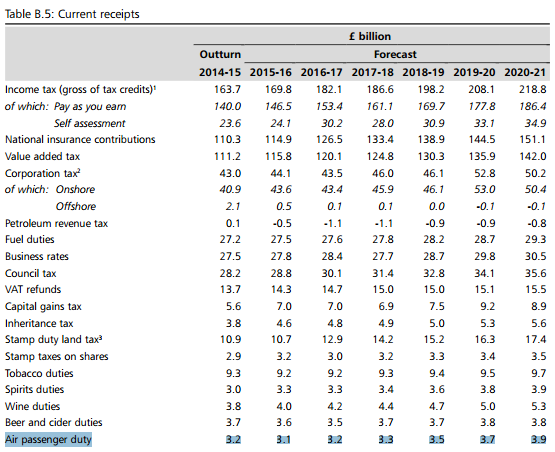

2016

The March 16th 2016 Budget showed the anticipated take from a range of UK taxes, over the period 2014-15 to 2020-21.

The full table is on Page 139 (only part of the table reproduced here)

2011

(Page 77 of Treasury Autumn Statement 2011) http://cdn.hm-treasury.gov.uk/autumn_statement.pdf

.

Cost of employing a nurse in the NHS for one year

It is assumed that the cost of employing a nurse for a year in the NHS is about £40,000. The figure below, from the University of Surrey and NICE ( link ) gives a figure of about £32,000.

£800 million could – if nurses cost £40,000 per year each – pay for 20,000 nurses.

“This figure calculated by adding the mean annual basic salary (excluding overtime) of an Agenda for Change Band 5 nurse of £25,744 to the mean on-costs of employing the nurse of £6,123 taken from the Personal Social Services Research Unit costings for July 2013-June 2013. It excludes overheads, capital costs, overtime, London weightings or training and qualification costs.” NICE

IAG reaction ….

There was the standard, predictable, self-interested bleating from IAG’s Willie Walsh, as expected, reacting to the budget. He wants more money for his airline, by there being no tax on flights. [ Even the (non-green) Chancellor can see this is illogical nonsense. ]

http://www.travelmole.com/news_feature.php?news_id=2021242