How much profit do airports make from their retail activities, rather than flying?

Heathrow got 21.3% of its income from retail in 2010, compared to 53% from aeronautical. On average each Heathrow passenger spent about £5.70 (maybe £5.90) at the airport, with women spending more than men (!). BAA data say frequent fliers spend more than infrequent fliers. In the year 2010/2011 Gatwick airport made £115.6m from retail, and another £51.7m from car parking, with an average of £5.80 spent on retail per passenger. Stansted retail spending per passenger is about £4.00 to £4.20. In the year 2010/2011 Heathrow made about £380 million per year on retail, Gatwick about £115, and Stansted net retail income fell from £79.8m in 2010 to £73.9m. Manchester made about £70 million on retail, with about £3 per passenger.

Heathrow income from retail

Influence of passenger mix on retail spend

• Long haul passengers significantly higher spenders than short haul

• Origin and destination passengers higher spenders than transfer passengers – in terminal and they use car parks!

• Intra-terminal transfer passengers higher spenders than inter-terminal passengers

• Women higher spenders than men

• Frequent fliers spend more than infrequent fliers

• 35% of passengers are transfers

• 34% are travelling on business

• 57% are men

• 53% are flying long haul

Retail Revenue

The Company’s net retail income was £12m (3%) higher than the forecast, despite lower passenger volumes.

The income lost from lower passenger numbers was recovered through the net retail income per passenger which was 16% higher than forecast, mainly driven by duty and tax free shops (including specialist airside retail) and bureau de change, where income per passenger was 31% and 24% ahead of forecast respectively.

Retail income year to March 2011 £379.1 million

Property income £129.6 million

Total revenue £1,853 million

which is 20.5%

Gatwick retail spending

Retail revenue increases at London Gatwick airport

Andrew Pentol

Gatwick Airport Limited records total retail revenue of £115.6m in the year ended March 31 2011

Gatwick Airport Limited has revealed total retail revenue of £115.6m ($185.3m) for the financial year ended March 31 2011 compared to the £115m ($184.4m) for the same period last year.

According to Gatwick Airport Limited’s annual report, 31.6m passengers travelled through the airport, representing a 2.3% decrease year-on-year. The decrease in passenger numbers was driven by a number of factors, the most significant being the closure of aerospace in the three months to June 30 2010 following the eruption of mount Eyjafjallajokull in Iceland.

Despite the fall in passengers, duty-free, tax-free and specialist shops sales increased from £58.0m ($93m) in the year ended March 31 2010 to £58.9m ($94.4m) in the year ended March 31 2011.

Revenue from other in-store retail reached £36.5m ($48.5m) while net retail income per passenger rose £0.09 ($0.14) to £3.62 (£5.80) compared to the previous year.

Car parking income also increased £1.3m to £51.7m.

Gatwick Airport Limited is run by US investor Global Infrastructure partners following the acquisition of the airport from BAA.

Gatwick airport chief executive officer Stewart Wingate said: “We delivered strong performance in our first full year of new ownership despite the challenging environment and extraordinary events that affected major airports across Europe. Resilient passenger traffic combined with our relentless focus on cost efficiency helped us achieve solid financial results. We also successfully reinforced the business, enhancing our capital structure and establishing a strong liquidity position.

“We worked in partnership with the airlines to re-scope our new £1bn ($1.6bn) capital investment programme, which is now being delivered with greater efficiency and pace. Passengers and airlines are already benefitting from new, modern facilities and we are currently investing around £20bn ($32bn) per month. Operational performance and service standards have also improved significantly which is helping Gatwick compete to grow and become London’s airport of choice.”

Stansted’s retail income

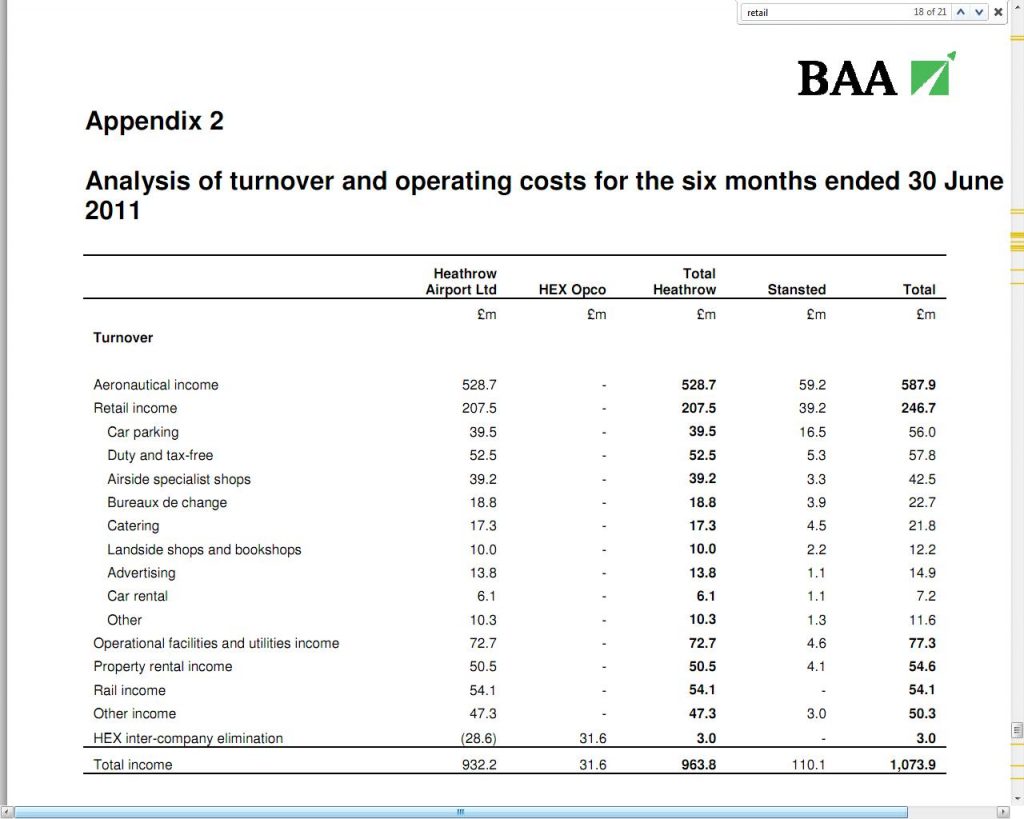

BAA HY1 retail income rises 14.2% to $404m (HY means half year)

BAA’s retail business continued to perform very well in the first six months to June 2011, with net retail income (NRI) per passenger increasing by 7.6% to £5.59 ($9.15) compared with £5.20 ($8.51) in 2010.

The performance was led by Heathrow where NRI per passenger was up 7.7% to £5.98 ($9.79) and by 4.2% to £4.10 ($6.71) at Stansted.

This performance was based on gross retail income increasing by 14.2% to £246.7m ($404m) and record Heathrow passenger traffic levels throughout the second quarter of 2011. Heathrow traffic grew by 9.1% in the six months to 32.9m, while Stansted traffic edged up 0.2% to 8.5m over the same period.

Breaking passenger traffic down by market across both airports, UK domestic accounted for 3m (+1.1%); Europe 20.9m (+7.5%); and long haul 17.4m (+7.8%).

DUTY AND TAX FREE LED SALES

BAA Management said the retail performance was led by duty and tax free, airside specialist shops, car parking and catering. Strength in duty and tax free was supported by a new walk-through area in the World Duty Free store in Terminal 3 and extension of the store in Terminal 5.

In airside specialist shops, the luxury segment continued to benefit from strong trading consistent with experiences in this sector outside airport outlets. Strength in car parking reflected increased usage, tariff increases and strength in premium business usage.

Stansted’s gross retail income increased 3.7% to £39.2m ($64.2m) compared with £37.8m ($61.9m) in 2010. BAA said that growth in Stansted’s retail income reflects a higher performance in car parking due to achieving higher yields per user.

Over the whole of 2011, the Group continues to expect growth in net retail income per passenger to moderate from recent levels to around 6%, as disclosed in the investor report issued in June 2011.

Stansted accounts to March 2011 state:

Retail income

Net retail income (“NRI”) declined 7.4% to £73.9m (2010: £79.8m). The main reason for this decline was the reduction in passenger numbers. NRI per passenger has been maintained around £4.04 due to initiatives stabilizing car parking income.

Other income

Other income increased 0.9% to £23.6m (2010: £23.4m) largely due to rental income from

residential properties purchased in connection with the second runway project, transferred into investment properties from November 2010 onwards, offsetting a decrease in passengers with reduced mobility (“PRM”) income due to fewer passengers

2011 2010

£m £m

Retail 73.9 79.8

Property 13.5 13.8

Net revenue from

airport charges 121.6 132.9

Total revenue 219.1 236.1

% from retail 33.7% 33.8%

Manchester Airport’s retail income

Accounts for 2010/2011 state

Overall retail income of £69.8m has fallen by £0.6m, a reduction of just 0.9%, which is attributable to the reduction in income experienced as a result of the volcanic ash business disruption and after adjusting for this, income is estimated to have grown by 1.1%.

Income from retail concessions was £69.8 million in 2011 ( £70.4 in 2010) with total income £350.2 million in 2011 (and £ 349.8 in 2010). There were 22.8 million passengers, so spending about £3 per passenger on retail ?

That’s 20% of income.

Total income per passenger (not retail spend) was £7.1.

Airport shopping pages:

Just some of them:

The Heathrow airport website on its shopping and eating is at

http://www.heathrowairport.com/shop,-eat,-relax-and-enjoy

and Stansted’s http://www.stanstedairport.com/shopping-and-eating

September 12, 2011 (Financial Times)

High-spending tourists boost airport sales

By Claer Barrett, Retail Correspondent

(extracts)

“A shopping centre with a runway attached,” is how one retailer describes the growing attractions of airports, which are leaving the UK’s high streets behind in terms of sales growth.

===

Airport operators have been quick to respond by upping their quota of luxury retailers. Harrods opened a “walk through” designer store after the redevelopment of Heathrow’s Terminal 3 this year, offering concessions from brands including Cartier, Ralph Lauren and Etro.

A spokesman reports “exceptional” sales to passengers from the Middle East, China, Russia and more traditional long-haul destinations such as the US.

This autumn, Miu Miu will open its first UK airport store at Heathrow, rubbing shoulders with British luxury brands Burberry and Mulberry, which also report record sales from their airside outlets. This all helped to push Heathrow’s overall passenger spending to £208m ($328.7m) in the six months to the end of June, a 16.4 per cent increase on the same period a year ago.

=======

Gatwick, which is orientated towards UK holidaymakers, also reports that UK shoppers are more likely to relax their discretionary spending when they are in a holiday mood.

======

Most retailers in Gatwick outperform their average high street store equivalent due to the captive audience – passengers spend 80 minutes on average in the departure lounge. To up the level of spend, the airport is in the process of redeveloping its retail space to create more “airside” than “landside” shopping, noticing that passengers find it easier to relax and spend once they are through security.

“When you’re in a holiday frame of mind, you’re more likely to spend on discretionary items here than on the high street, and the VAT saving makes it considerably cheaper,” she adds. Many new retailers can see the opportunity, she says, but have to weigh this up against the long opening hours (typically 4am to 10pm), security requirements of getting staff and stock airside, and reverse seasonality of trade.

“In the airport, it’s summer almost all year round,” she says. “High street retailers might not be selling bikinis in December, so it’s imperative we provide them at the airport.”

Full article at

http://www.ft.com/cms/s/0/3ecc0056-dd57-11e0-9dac-00144feabdc0.html#axzz1mgWsr4Rv

By comparison, this story from 2008:

Heathrow profits up 10 per cent to £438 million

15.4.2008 (Times)

Heathrow’s profits rose by more than 10% last year, despite the UK’s largest international airport coming under repeated criticism for its poor service and standards.

Accounts for the private holding company that owns BAA, the airports operator,

show that Heathrow’s operating profits rose by £40 million to £438 million in 2007.

Profits at Stansted rose 68% to £86 million after BAA doubled the charge for each passenger using the airport.

The sharp rise in profits angered airlines who use BAA’s facilities.

They claim that the company is making huge profits but is failing to offer a

good service. Heathrow, in particular, has faced repeated criticism for long

security queues and the poor quality of its infrastructure.

The rising profits will provide airlines with further evidence that BAA is abusing

its position as the owner of London’s three main airports.

The Competition Commission is expected this month to deliver its preliminary

findings on whether BAA’s London monopoly should be broken up.

Jim Callaghan, the head of regulatory affairs at Ryanair, said: &lquot;BAA is abusing

its monopoly position by charging outrageous fees while providing a rubbish service

and that is why they can enjoy huge profit increases.&rquot;

BAA was bought by Ferrovial, the Spanish infrastructure company, in 2006 through

a subsidiary called Airport Development and Investment Limited (ADIL), which filed 2007 accounts with Companies House last week.

The ADIL figures show that revenue for BAA’s seven UK airports, as well as Naples

airport in Italy, was £2.2 billion, up 7.9% from the previous year. The company

made profits of £745 million, up 13.4%.

The accounts also show that ADIL is reducing the amount that it spends on new infrastructure at Heathrow, despite BAA’s claims that it is working to improve the facilities.

Capital expenditure was £875million last year compared with £977million in 2006.

BAA said yesterday that this was due to reduced spending on Terminal 5 as it

neared completion.

However, Ferrovial has been unable to reap the full rewards of BAA’s big profit

increase because of enormous interest payments on the debt taken to finance the

BAA acquisition.

ADIL was able to pay Ferrovial and its other backers only £86 million last year

after interest payments of £964 million.

ADIL’s total debt stands at £16.9 billion and Ferrovial has been unsuccessfully

trying to refinance in order to reduce the interest payments.

If it fails to refinance within the next two months, BAA’s credit rating is likely

to be moved to junk status.

Ferrovial has sold World Duty Free and part of its property portfolio in an attempt

to reduce its debt levels.

The criticism of Heathrow’s profits comes as British Airways faces its own problems

at the airport, particularly the recent chaotic move into its new home at Terminal

5.

Standard Life Investments, BA’s second-largest shareholder, has begun a series

of meetings with senior executives at the airline.

It is understood that Standard Life will meet Willie Walsh, BA’s chief executive,

today having spoken to Martin Broughton, the chairman, yesterday.

The problems at Terminal 5 are thought to be only one of a list of issues that

will be raised with management.

The meeting comes as investors are becoming increasingly alarmed at the bad news

coming from Britain’s flag carrier.

The T5 debacle followed a profits warning last month and shareholders are concerned

that a malaise has started to set in at senior management level.

“We need to be sure that BA is prepared for a deteriorating operational environment.

The economy is turning down and fuel costs have turned up” a shareholder said.

BAA money-spinners:

Full-year 2007 figures

(% comparison with previous year)

Airside shops

(not including Duty Free)

£74 million (+8.4%)

Landside shops and bookshops

£48 million (+0.3%)

Restaurants and cafés

£60 million (+3.6%)

Bureaux de change

£57 million (-1.3%)

Car parking

£164 million (+5.5%)

Car rental

£22 million (+5.3%)

Advertising

£36 million (+5%)

Source: ADIL accounts

Times

Heathrow profits up 10 per cent to £438 million

.

.

See also

Airport retail: rise and rise of the shopping centre, with an airport attached

14.3.2012

and

European airports, like those in UK, make large part of their income as shopping centres

22.10.2012

Investors in airports are being drawn to the profit being made by the real estate and retail income they generate. Among European airports, Aeroports de Paris derived 39% of its revenue from real estate and retail in 2011; Zurich took in 50.3%; and Danish airport operator Koebenhavns Lufthavne A/S collected 33.6%. At TAV (Turkey), the share was 33%, and at Vienna it was 19%. Airports generally get the majority of their retail revenue after passengers check in and go through security. Goldman Sachs lists retail revenue as a major factor in recommending European airports to invest in. Two weeks ago, Fraport opened Pier-A-Plus, a terminal extension at Frankfurt, allowing Germany’s biggest hub to serve up to 6 million passengers a year and adding 50% to the airport’s retail space. According to ACI, air passenger numbers in Europe are up 2.3% this year compared to 2011, but Eurocontrol forecast that annual traffic growth will average 1.9% over the next 7 years in Europe, due to high oil prices and a weaker economic outlook. Details at https://www.airportwatch.org.uk/?p=3133