Gatwick Airport has told its shareholders, including Global Infrastructure Partners and Abu Dhabi’s sovereign wealth fund, that it expects to pay £250 million in dividends over the next three years, after flying back into the black in 2013.

The West Sussex airport, which is currently battling for the right to build a second runway, will significantly ramp up returns to investors by April 2017; it expects to pay £125m in the current financial year, compared to £10m for the year to March 31. Gatwick has also guided towards a £65m return to investors in the 2015/16 financial year and £60m in the following 12 months.

Gatwick’s shareholder register is dominated by Global Infrastructure Partners, with 41.95%, followed by the Abu Dhabi Investment Authority with 15.9%. US pension fund, the California Public Employees’ Retirement System (CalPERS) owns 12.78%.

Gatwick’s chief executive, Stewart Wingate, revealed the dividend guidance alongside the airport’s results for the 12 months to March 31, which showed a 10% jump in turnover to £593.7m as a record 35.9m passengers passed through its doors, up 4.8%. This helped Gatwick return to the black, posting an £85.8m pre-tax profit from a £28.3m loss previously.

“In the previous period what we have been doing is paying down the shareholder loan we had in place. Now we are moving into starting to pay dividends through the business,” said Mr Wingate.

In the last year, the vast majority of passenger growth came from short-haul carriers to Europe. The number of people flying to destinations in Europe rose 6% to 29.7m while Emirates’ decision to introduce larger planes on routes out of Gatwick helped to grow traffic on routes to the Middle East and Central Asia to more than 807,000 passengers from almost 689,000 previously. However passenger numbers to North America; the Caribbean and Latin America; Northern and Sub-Saharan Africa and the Far East and South Asia all declined in the year.

Mr Wingate insisted Gatwick still had the strongest case for expansion – it is in a head-to-head battle with rival Heathrow to persuade the Government-appointed Airports Commission that it should have the right to build the next runway in the south east of England.

Gatwick will publish next month a more detailed report setting out the economics of its case for a second runway, after a recent claim that its contribution to the UK economy would be £40bn greater than that of an expanded Heathrow was called into question by rivals.

.

.

Gatwick airport’s 31st March 2014 results:

March 2014 – end of year results

September 2013 – half year results

.

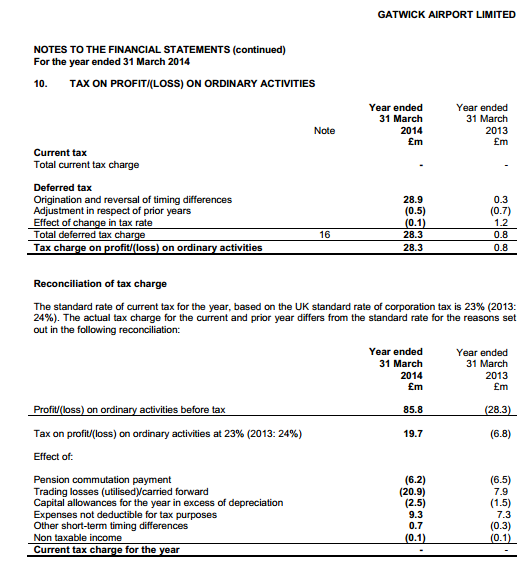

Gatwick tax payments

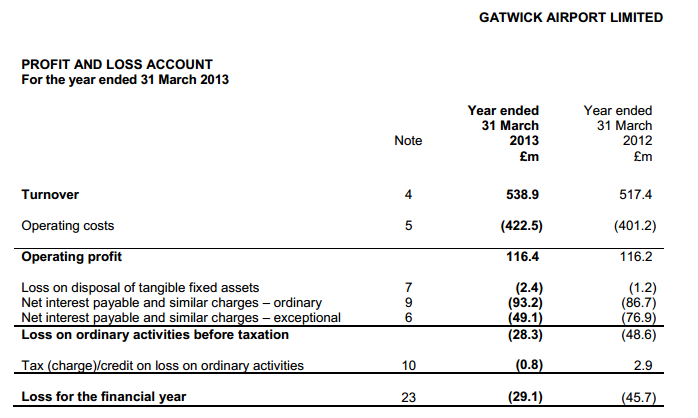

Gatwick’s Financial Statements for last year, dated 31st March 2013, showed Gatwick Airport paid no UK tax. It also paid no tax in the previous few years.

Like most large companies, Gatwick Airport Ltd has complicated accounts, and uses many (perfectly legal in current UK tax law) devices by which to reduce its tax burden.

Gatwick’s Financial Statement says:

“The Company is a wholly-owned subsidiary of Ivy Holdco Limited, a United Kingdom (“UK”) incorporated company, and is ultimately owned by a consortium through a number of UK and overseas holding companies and limited liability partnerships.

Gatwick Airport Limited owns 100% of the share capital of Gatwick Funding Limited, a company incorporated in Jersey but resident in the UK for tax purposes. The primary purpose of Gatwick Funding Limited is to raise external funding and provide it to Gatwick Airport Limited. This is done through the issuance of external bonds and the use of external interest rate and index-linked derivatives, the terms of which are then replicated in a “back-to-back” agreement with Gatwick Airport Limited. “

Separate companies based in Luxembourg and in the Channel Islands deal with foreign investments, lend money to each other, and a variety of complicate financial dealings. The net effect is that no UK corporation tax is paid. However, some of the tax avoidance is by improvements to the airport and investment in facilities, which government tax law allows to be offset against taxation.

Two pages from the March 2013 Financial Statement:

(Page 37 link)

.

and

.

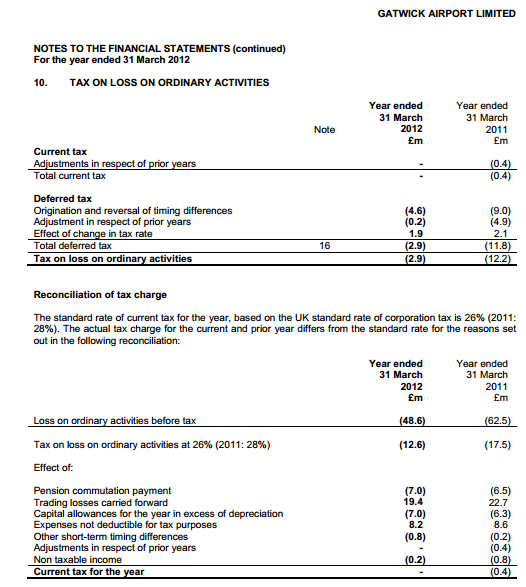

Gatwick’s Financial Statement for March 2012:

.

.

.

Earlier:

Gatwick Airport sees profits and passenger traffic rise26 November 2013 (BBC)

Profits and passengers numbers are up at the UK’s second-largest airport, Gatwick.

Pre-tax profits in the six months to 30 September were £127.3m, up from £107.2m in the same period last year.

The number of passengers using Gatwick rose 4.4% to 20.8 million.

The figures were boosted by continued strong growth from budget European airline Easyjet, although Gatwick has also seen the start of several new international services.

Stewart Wingate, Gatwick’s chief executive, renewed calls for a new runway to be sited at the airport, arguing that the figures confirmed the increasing popularity of the facility.

The government has commissioned a report into airport capacity in south-east England. Several business groups and airlines have called for expansion at Heathrow airport.

But Mr Wingate told the BBC that building a new runway at Gatwick would be substantially cheaper than expanding at Heathrow.

Gatwick was owned by the former BAA until private equity fund consortium Global Infrastructure Partners took over in December 2009.

Mr Wingate said: “Gatwick will celebrate four years of new ownership in December. In this time we have turned around decades of under-investment to enable Gatwick to emerge as a competitive, world-class airport.

“A new runway here would deliver the routes that passengers actually want at a better price, more quickly and with significantly less environmental impact. The UK’s next runway has got to be at Gatwick.”

http://www.bbc.co.uk/news/business-25099984

.

.

.

Increased profits for Gatwick Airport

Gatwick Airport has announced increased half-yearly profits of £172m and a growth in passenger numbers.

Profits increased by 4.8% over the same April to September period in 2011.

Gatwick was sold in 2009 after the Competition Commission ruled BAA must also sell Stansted and either Glasgow or Edinburgh airports.

Stewart Wingate, Gatwick’s chief executive, said: “Three years of competition has seen Gatwick grow its European short-haul business.”

He added that the airport was also opening up new long-haul routes to Russian, China, Vietnam and Korea.

‘Exploring second runway’

During the same six-month period, turnover was up by 3.6% to £325.8m and passenger numbers also increased by 1.2% to 19.9 million.

Mr Wingate said: “This proves passengers are best served by allowing airports to compete.

“It is why we recently announced our plans to explore second runway options as we believe growth at Gatwick is the best option for increasing connectivity for the next generation”

A legal agreement currently prevents a second runway being built at the West Sussex airport until 2019.

In June, Gatwick announced plans to handle up to 40 million passengers a year by 2021, increasing to 45 million annually by 2030.

Mr Wingate said: “Over the next three years we will continue to transform the airport, maximising the opportunities in the short-haul market while stepping up our efforts to attract airlines that serve markets of strategic importance to the UK.”

Gatwick said about 23,000 people were employed at the airport, with a further 13,000 jobs in related businesses in the South East.

http://www.bbc.co.uk/news/uk-england-sussex-20525800

.

.

.