Sunday Times reports how Heathrow has paid its owners dividends of £2.1 billion since 2012 – but just £24 million in Corporation Tax

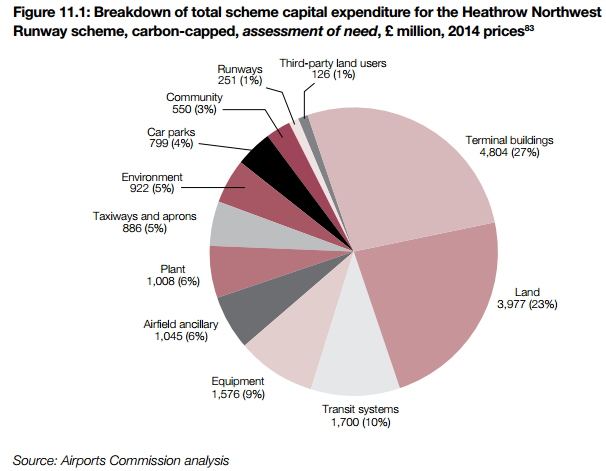

The Sunday Times reports that Heathrow has paid its owners back £2.1 billion in dividends, starting in 2012. But it has only paid a total of £24 million in corporation tax since 2006, with that payment being last year. Heathrow’s owners are rewarded whenever the value of the airport increases. If new airport infrastructure is built, the passengers pay for it through the £20 cost on their ticket (and other spending), and the owners benefit.. The CAA calculates how much is spent on investment, and allows Heathrow’s investors to earn a return on the total. The more Heathrow spends, the more its backers can earn. If Heathrow was to spend £17.6 billion on its expansion, the value of the airport would be considered to have increased that much. Due to the huge debts Heathrow has (£12.5 billion out of the £16 billion Ferrovial paid in 2006) the airport’s banks prevented dividends to owners, until 2012. They got £240 million in 2012, which has risen to £2.1 billion. Some of the proceeds of the sale of Gatwick, Edinburgh etc has been used for dividends. The Sunday Times says: …”with a debt-to-assets ratio of about 85% is one of the most heavily indebted airports in the world.” Heathrow will have to recoup the money by high passenger charges, years before the runway is built and open, as otherwise Heathrow’s massive investors are not prepared to take the financial risk. Heathrow is no longer a company quoted on the stock exchange, but that could happen in future.

.

Tweet

There is a useful briefing on the subject of how Heathrow would fund its runway, by the Richmond Heathrow Campaign. “Deliverability” at http://rhcfacts.org/deliverable/

Heathrow’s pot of gold at end of runway

.

Also

Heathrow pays £2bn to owners — and £24m tax

See earlier,

Willie Walsh tells AOA conference Heathrow’s runway is too expensive, and at that price, would fail

The Airport Operators Association is holding a two day conference on the runway issue, and Willie Walsh (CEO of IAG) was its key speaker. He said Heathrow should not get a 3rd runway, if the Airport Commission’s calculation of the cost of building it is correct. He said: “The Commission got its figures wrong – they are over-inflated. If that is the cost [of a new runway], it won’t be a successful project.” He described the assumption that airlines would pay for the new runway through increases in fares as “outrageous”. British Airways is by far the biggest airline at Heathrow, with 55% of the slots. He said of the Commission’s report: ” … I have concerns about the level of cost associated with the main recommendation and the expectation that the industry can afford to pay for Heathrow’s expansion.” He does not believe the cost is justified, and “If the cost of using an expanded airport significantly exceeds the costs of competitor airports, people won’t use it.” It was not realistic for airlines: “You have to see it in terms of return on capital. ….Either the figures are inflated or you are building inefficient infrastructure. I do not endorse the findings. I definitely don’t support the costs of building a runway. If those costs are real, we should not build it.” On the cost of £8 billion to build a 6th terminal he commented: “How many chandeliers can you have in an airport terminal?

Click here to view full story…

.

British Airways-owner CEO, Willie Walsh, opposes new Heathrow runway as too expensive to airlines

British Airways-owner IAG does not support the building of a 3rd Heathrow runway, its chief executive said, because the costs of the project does not make sense for the airline. Willie Walsh said: “We think the costs associated with the third runway are outrageous and certainly from an IAG point of view we will not be supporting it and we will not be paying for it. …We’re not going to support something that increases our costs.” British Airways is the biggest airline at Heathrow [it has around 50% of the slots]. An expanded Heathrow with a new runway would be partly paid for by higher charges to airlines. In May this year he had said “the cost of all three [runway] options are excessive and would translate into an unacceptable increase in charges at the airports.” Not to mention the problems of politics and unacceptability to the public. The Airports Commission’s final report says, with a new runway at Heathrow, “The resulting impact on passenger aeronautical charges across the Commission’s four demand scenarios for Heathrow is an increase from c. £20 per passenger to a weighted average charge of c. £28-30 per passenger and a potential peak of up to c. £31.”

Click here to view full story…

.See also

Gatwick Airport paid no Corporation Tax in three years

Gatwick Airport has a £1.2 billion capital investment programme to improve its infrastructure and facilities. But it paid no corporation tax for three consecutive years despite making £638m in profit before tax. Gatwick tried to defend this position, saying: “Whilst year on year we have lessened our financial losses we have yet to make a profit after tax. As a result the airport has not paid corporation tax …Our current £1.2bn capital investment programme and existing asset base, together with the associated debt structure, result in depreciation and interest costs which reduce our operating profits to a loss before tax.” In the 2012/13 year, Gatwick Airport made £227.1m profit before tax, a 2.5% increase, as it benefited from flights to new destinations in China, Russia, Indonesia, and Turkey. Despite this, it reported a net financial loss of £29.1m, citing asset depreciation and £226.7m of capital investment in the year. Corporation tax is only levied on a company’s net profit. In the UK the corporation tax rate is 23%. Under UK tax law, corporations can claim tax allowances on certain purchases or investments made on business assets. Campaign group UK Uncut estimates that clever accounting rules and complex tax avoidance schemes cost Britain £12bn annually.

https://www.airportwatch.org.uk/2013/06/gatwick-airport-paid-no-corporation-tax-in-three-years/

.

Margaret Hodge: Gatwick runway appeal ‘is hypocritical when it avoids corporation tax’

Gatwick has been accused of “hypocrisy” for avoiding corporation tax while campaigning to build a new runway, allegedly for the benefit of the UK economy. Margaret Hodge, head of Parliament’s Public Accounts Committee, said the airport should pay its “fair share” if it wants its runway campaign to be credible. She also criticised Heathrow which has not paid corporation tax for several years. But she particularly criticised Gatwick. Its Guernsey-based parent company Ivy Mid Co LP has invested in a £437 million “Eurobond” which charges the airport 12% interest, thus avoiding tax. Gatwick says this sort of bond is often used by other infrastructure companies. Companies in the UK should pay 21% corporation tax on profits, but by spending £1 billion on upgrading the airport, Gatwick has made no profit recently. Despite pre-tax loses in recent years, it has paid dividends to its overseas shareholders of £436 million. Heathrow has also avoided profits by investing in new buildings etc. Mrs Hodge said the companies “made a fortune” from their UK activities, which relied on public services, adding: “For them to pretend they are only in it for the benefit of the UK economy is a touch hypocritical.”

.

.

.

.