Heathrow’s shareholders get £500m as profits rise (including income of £126m from car parking)

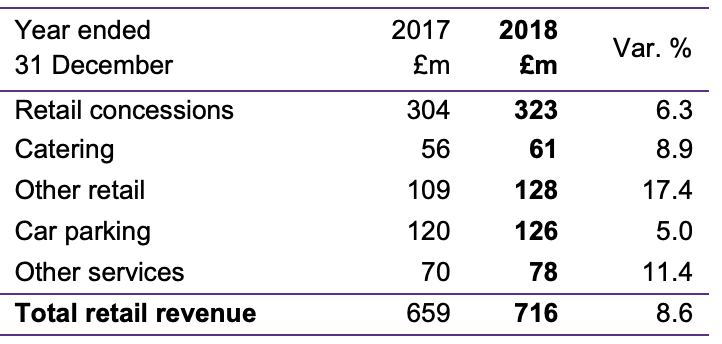

IAG, the owner of British Airways, is angry that Heathrow has paid out £500 million in dividends to its foreign investors while charging its airline customers more. IAG says the dividend payments – now totalling £3.5 billion since 2012 – make Heathrow more costly for airline passengers (so slightly deterring them from flying perhaps). Heathrow said “It is right that our shareholders receive returns in record years and it will ensure we expand whilst keeping airport charges close to 2016 levels.” Heathrow’s top shareholders include the Qatar Investment Authority, Singapore’s GIC and the China Investment Corporation. Its largest single investor is Spain’s Ferrovial. The only UK shareholder is the Universities Superannuation Scheme (USS) with a 10% stake. Heathrow’s figures out last week show revenue growth of 3% to £2.97 billion in 2018 with 80.1 million passengers (up 2.7% from 78 million). Car parking income was £126 million (up 5% from £120 million in 2017). Retail revenue per passenger was £8.94 (up 5.8% from £8.45 in 2017). Total retail income was £716 million (up 8.6% from £659 million in 2017). Heathrow paid £70 million (2017: £53 million) in corporation tax. Out of £2,970 million total revenue.

.

Tweet

.

BA fury after Heathrow’s shareholders land £500m while the airport continues heaping costs on customers

British Airways blasted Heathrow Airport for paying out £500m in dividends

The airline’s boss suggested the dividend payments make flights more costly

By WILLIAM TURVILL,

FINANCIAL MAIL ON SUNDAY (This is Money)

23 February 2019

Heathrow Results for the year ended 31 December 2018

The owner of British Airways last night hit out at Heathrow for paying another £500 million in dividends to the airport’s foreign investors while it heaps costs on customers.

International Airlines Group, led by Willie Walsh, suggested the dividend payments – now totalling £3.5 billion since 2012 – make Heathrow more costly for fliers.

‘Britain needs cost-effective airport infrastructure that boosts the UK’s competitiveness, not just the airport’s shareholders,’ an IAG spokesman said.

‘Heathrow is already the most expensive hub airport worldwide and the Government must protect consumers by putting a cap on what they pay to use it.’

But a Heathrow spokesman said it reduced passenger charges last year, adding: ‘It is private investment that has transformed Heathrow into what it is today, providing IAG with some of its most profitable routes.

It is right that our shareholders receive returns in record years and it will ensure we expand whilst keeping airport charges close to 2016 levels.’

Heathrow’s top shareholders include the Qatar Investment Authority, Singapore’s GIC and the China Investment Corporation. Its largest single investor is Spain’s Ferrovial.

The airport last week revealed revenue growth of 3% to £2.97 billion in 2018 when Parliament backed a third runway at Heathrow. A record 80.1 million passengers used the airport last year.

.

.

A few notes from the Results document:

.

Retail revenue growth was strong across all revenue streams with retail concession reflecting higher passenger numbers as well as our call to gate initiative which increases passenger dwell time in the departure lounge. Retail concessions were additionally boosted by the roll out of new digital capability on Heathrow boutique, allowing customers to reserve and collect their shopping, with 52 brands now offering this service. Catering also benefitted from the call to gate initiative, and strong performance in the year was further enhanced by refurbishments in Terminals 3 and 5, as well as “Grab & Go” offerings for passengers to take meals on flights. Other retail reflects a significant increase in advertising income from improved utilisation of advertising spaces. Retail revenue per passenger rose 5.8% to £8.94 (2017: £8.45).

Taxation The tax charge for the period, before certain remeasurements, was £58 million (2017: £48 million) resulting in an effective tax rate of 21.7% (2017: 22.1%), compared to the UK statutory rate of 19% (2017: 19.25%). The effective tax rate being higher than the statutory rate reflects the fact that a substantial proportion of Heathrow’s capital expenditure does not qualify for tax relief. The total tax charge for the year was £89 million (2017: £95 million). For the period ended 31 December 2018, the Group paid £70 million (2017: £53 million) in corporation tax.

.

.

.